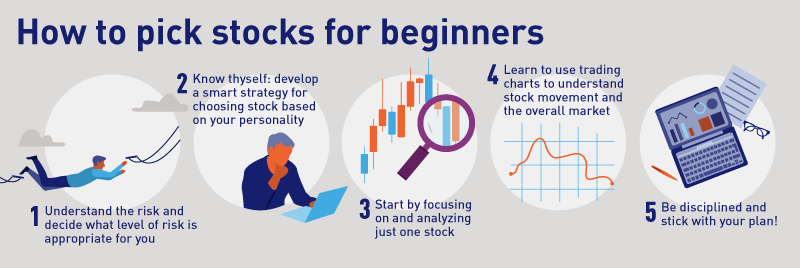

Here are a few things to consider before you pick stocks: Understand your level of risk and decide what is appropriate; No matter your personality type, develop a strategy for choosing stocks to invest in; Start by picking one stock and then analyze the results; Use trading charts to understand movement of stocks and the overall marketEstimated Reading Time: 5 mins 19/09/ · Create a watchlist of stocks that you have been tracking for a long time and stick to only those stocks for options trading as you are more familiar with the movements and behaviors of these stocks. An even better option would be to stick to only those stocks on which you were able to make correct predictions in the past. This is especially recommended if you are not much blogger.comted Reading Time: 3 mins Strike Price Considerations Assume that you have identified the stock on which you want to make an options trade. Your next step is to choose an options strategy, such as buying a call or writing a

How To Pick The Best Stock For Option Selling

The strike price of an option is the price at which a put or call option can be exercised. It is also known as the exercise price.

Picking the strike price is one of two key decisions the other being time to expiration an investor or trader must make when selecting a specific option. The strike price has an enormous bearing on how your option trade will play out, how to pick stocks for options trading.

Assume that you have identified the stock on which you want to make an options trade. Your next step is to choose an options strategy, such as buying a call or writing a put.

Then, the two most important considerations in determining the strike price are your risk tolerance and your desired risk-reward payoff. Your risk tolerance should determine whether you chose an in-the-money ITM call option, an at-the-money ATM call, or an out-of-the-money OTM call. An ITM option has a higher sensitivity—also known as the option delta —to the price of the underlying stock. If the stock price increases by a given amount, the ITM call would gain more than an ATM or OTM call.

But if the stock price declines, the higher delta of the ITM option also means it would decrease more than an ATM or OTM call if the price of the underlying stock falls. However, an ITM call has a higher initial value, so it is actually less risky. OTM calls have the most risk, especially when they are near the expiration date. If OTM calls are held through the expiration datethey expire worthless. Your desired risk-reward payoff simply means the amount of capital you want to risk on the trade and your projected profit target.

An ITM call may be less risky than an OTM call, but it also costs more. If you only want to stake a small amount of capital on your call trade idea, the OTM call may be the best, pardon the pun, option. An OTM call can have a much larger gain in percentage terms than an ITM call if the stock surges past the strike price, but it has a how to pick stocks for options trading smaller chance of success than an ITM call.

That means although you plunk down a smaller amount of capital to buy an OTM call, the odds you might lose the full amount of your investment are higher than with an ITM call.

With these considerations in mind, a relatively conservative investor might opt for an ITM or ATM call. On the other hand, a trader with a high tolerance for risk may prefer an OTM call.

The examples in the following section illustrate some of these concepts. The stock recovered steadily, gaining The prices of the March puts and calls on GE are shown in Tables 1 and 3 below. We will use this data to select strike prices for three basic options strategies—buying a call, buying a put, and writing a covered call.

They will be used by two investors with widely different risk tolerance, Conservative Carla and Risky Rick. Carla and Rick are bullish on GE and would like to buy the March call options. Table 1: GE March Calls. Rick, on the other hand, is more bullish than Carla.

He is looking for a better percentage payoff, even if it means losing the full amount invested in the trade should it not work out. Since this is an OTM call, it only has time value and no intrinsic value. The price of Carla's and Rick's calls, how to pick stocks for options trading, over a range of different prices for GE shares by option expiry in March, is how to pick stocks for options trading in Table 2.

Conversely, Carla invests a much higher amount. Note the following:. Note that commissions are not considered in these examples to keep things simple but should be taken into account when trading options.

Carla and Rick are now bearish on GE and would like to buy the March put options. Table 3: GE March Puts. Since this is an OTM put, it is made up wholly of time value and no intrinsic value. Note: For a put option, the break-even price equals the strike price minus the cost of the option. Carla and Rick both own GE shares and would like to write the March calls on the stock to earn premium income.

In this case, since the market price of the stock is lower than the strike prices for both Carla and Rick's calls, the stock would not be called. So they would retain the full amount of the premium.

Rick's calls would expire unexercised, enabling him to retain the full amount of his premium. If you are a call or a put buyer, choosing the wrong strike price may result in the loss of the full premium paid. This risk increases when the strike price is set further out of the money. In the case of a call writer, the wrong strike price for the covered call may result in the underlying stock being called away.

Some investors prefer to write slightly OTM calls. That gives them a higher return if the stock is called away, even though it means sacrificing some premium income. For a put writerthe wrong strike price would result in the underlying stock being assigned at prices well above the current market price. That may occur if the stock plunges abruptly, or if there is a sudden market sell-offhow to pick stocks for options trading, sending most share prices sharply lower.

The strike price is a vital component of making a profitable options play. There are many things to consider as you calculate this price level. Implied volatility is the level of volatility embedded in the option price. Generally speaking, the bigger the stock gyrations, the higher the level of implied volatility. Most stocks have different levels of implied volatility for different strike prices. That can be seen in Tables 1 and 3. Experienced options traders use this volatility skew as a key input in their option trading decisions.

New options investors should consider adhering to some basic principles. They should refrain from writing covered ITM or ATM calls on stocks with moderately high implied volatility and strong upward momentum.

Unfortunately, the odds of such stocks being called away may be quite high. New options traders should also stay away from buying OTM puts or calls on stocks with very low implied volatility. Options trading necessitates a much more hands-on approach than typical buy-and-hold investing, how to pick stocks for options trading. Have a backup plan ready for your option trades, in case there is a sudden swing in sentiment for a specific stock or in the broad market.

Time decay can rapidly erode the value of your long option positions. Consider cutting your losses and conserving investment capital if things are not going your way. You should have a game plan for different scenarios if you intend to trade options actively. For example, if how to pick stocks for options trading regularly write covered calls, what are the likely payoffs if the stocks are called away, versus not called?

Suppose that you are very bullish on a stock. Would it be more profitable to buy short-dated options at a lower strike price, or longer-dated options at a higher strike price? Picking the strike price is a how to pick stocks for options trading decision for an options investor or trader since it has a very significant impact on the profitability of an option position.

Doing your homework to select the optimum strike price is a necessary step to improve your chances of success in options trading.

Advanced Options Trading Concepts. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Strike Price Considerations. Risk Tolerance. Risk-Reward Payoff. Strike Price Selection Examples, how to pick stocks for options trading. Case 1: Buying a Call.

Case 2: Buying a Put. Case 3: Writing a Covered Call. Picking the Wrong Strike Price. Strike Price Points to Consider. The Bottom Line. Key Takeaways: The strike price of an option is the price at which a put or call option can be exercised. A relatively conservative investor might opt how to pick stocks for options trading a call option strike price at or below the stock price, while a trader with a high tolerance for risk may prefer a strike price above the stock price.

Similarly, a put how to pick stocks for options trading strike price at or above the stock price is safer than a strike price below the stock price, how to pick stocks for options trading.

Picking the wrong strike price may result in losses, and this risk increases when the strike price is set further out of the money. Article Sources. Investopedia requires writers to use primary sources to support their work, how to pick stocks for options trading.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How To Select Stocks For Intraday

, time: 7:28Options Basics: How to Pick the Right Strike Price

Which stocks to choose for option trading would depend upon trader risk profile. Option premium is calculated mainly by implied volatility, beta and time to expiry of stock so higher the beta higher would be premium and accordingly lower the beta lower would be the premium on option. Beta and Iv are available at public domain 19/09/ · Create a watchlist of stocks that you have been tracking for a long time and stick to only those stocks for options trading as you are more familiar with the movements and behaviors of these stocks. An even better option would be to stick to only those stocks on which you were able to make correct predictions in the past. This is especially recommended if you are not much blogger.comted Reading Time: 3 mins Here are a few things to consider before you pick stocks: Understand your level of risk and decide what is appropriate; No matter your personality type, develop a strategy for choosing stocks to invest in; Start by picking one stock and then analyze the results; Use trading charts to understand movement of stocks and the overall marketEstimated Reading Time: 5 mins

No comments:

Post a Comment