Download Market Profile Indicator �� for MetaTrader 4️⃣ & 5️⃣, MT4 Various Indicators for Free at blogger.com 18/06/ · Settings for the calculation process of the Forex Market Profile Indicator. FMP Default Start Bar. The starting bar (leftmost) for the indicators calculation range,for the first time its applied to a chart. In mt4 the bars go from 0 (most recent) to Max(oldest) FMP Default End Bar 14/11/ · Forex Market Profile Indicator. The Market Profile was developed by Peter Steidlmayer. He discovered a natural show of the market (the volume) and represented it in such a way (a bell-shaped curve) that the objective information generated by the market can be blogger.comted Reading Time: 2 mins

Forex Market Profile - Forex Trading Hours - General - MQL5 programming forum

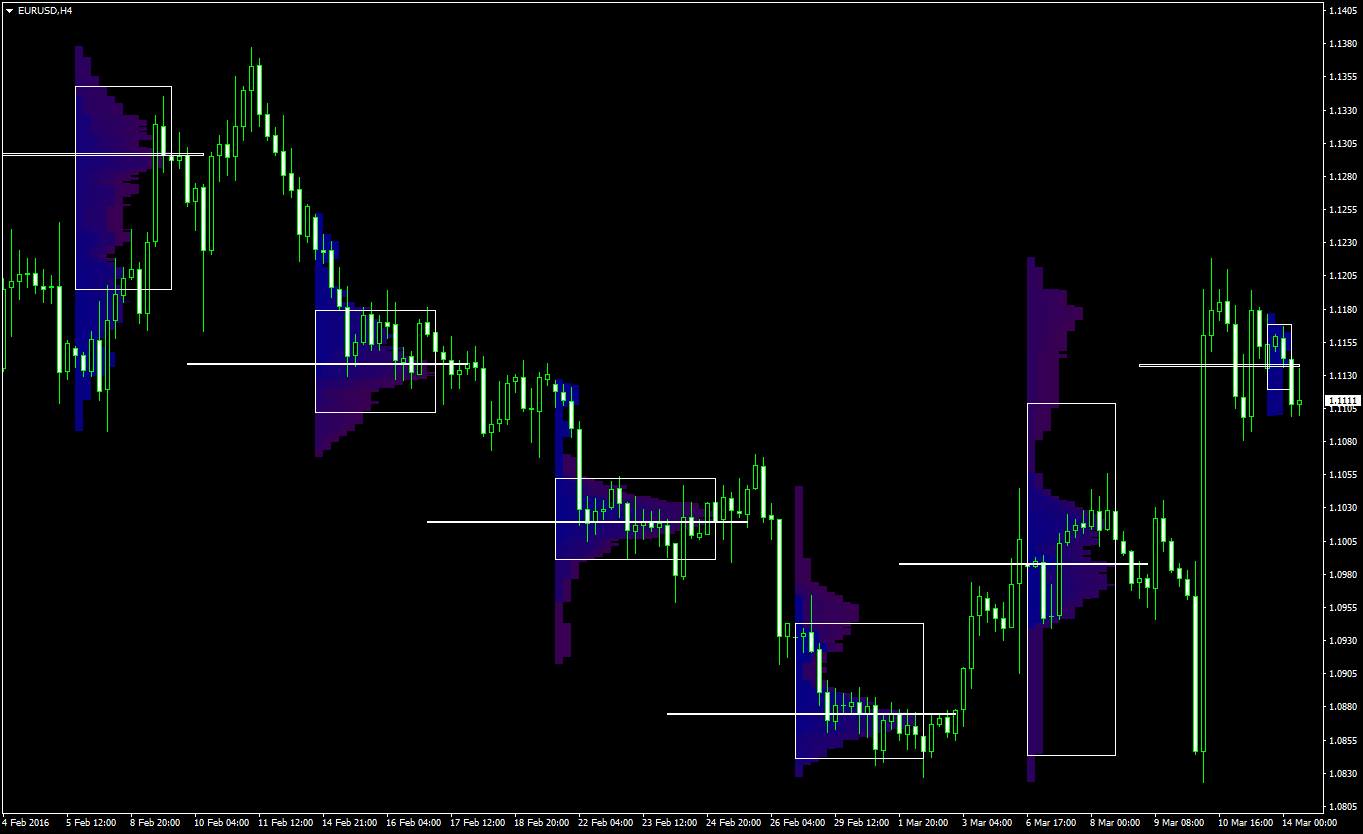

Market Profile MetaTrader indicator — is a classic Market Profile implementation that can show the price density over time, outlining the most important price levels, value area, and control value of a given trading session. This indicator can be attached to timeframes between M1 and D1 and will show forex market profile Market Profile for daily, weekly, monthly, or even intraday sessions. Lower timeframes offer higher precision.

Higher timeframes are recommended for better visibility. It is also possible forex market profile use a free-draw rectangle session to create a custom market profile on any timeframe, forex market profile.

Six different color schemes are available to draw the profile's blocks. Drawing profiles as a plain color histogram is also possible. This indicator is based on bare price action and does not use any standard MetaTrader indicators. It is available for both MetaTrader 4 and MetaTrader 5 platforms, forex market profile.

The chart screenshot shows market profiles calculated and displayed for two daily Forex trading sessions. The timeframe is M30 and the right-hand daily session is still in progress. The earliest prices are blue and the latest prices are red. The medians and the value areas are marked with the white lines and display the most important price areas. Traders tend to return to those areas if the volume of the breakout forex market profile is not too high.

High-volume breakout out of these areas signifies a real breakout. You can read more about Market Profile in this short forex market profile Book on Market Profile.

The example below demonstrates how the Market Profile can be colored according to the direction of each bar in the session rather than its age. This is done when ColorBullBear is set to true. This example demonstrates how the indicator can display a market profile based on the rectangle chart objects freely drawn by a trader, forex market profile.

For this to work, a rectangle object's name has to start with MPR and the Session input parameter has to be set to Rectangle. You can press 'r' on your keyboard to add such a rectangle to the chart automatically. Market Profile indicator can also draw histogram from right to left. Unlike the traditional left-to-right display, it can be helpful to focus on the current trading session, without obscuring its chart.

You can see how this works on the chart screenshot below, forex market profile. MarketProfile indicator is being developed via a dedicated GitHub repository. You are encouraged to actively participate in the improvement of this indicator by submitting your own features via pull-requests and reviewing existing suggestions, changes, fixes, and so on.

Market Profile indicator is a powerful tool developed by a CBOT trader. Its original purpose was to graphically organize price and time information obtained during a trading session in a manner useful to traders, forex market profile.

Today's Forex market is quite different from what commodity futures trading was back in when Peter Steidlmayer introduced his charting instrument to the public. Can Market Profile be a useful tool to Forex traders? The main difference between today's currency market and the futures market of 80's is the lack of daily trading sessions. Fortunately, it does not produce any real problems.

The lack of strict daily close and daily open can be compensated by one of the following methods:. Apparently, it is still possible to apply Market Profile to modern foreign exchange market.

The most consistent approach seems to be the third one, which is based on weekly sessions. Another important issue to solve when using this indicator in analysis is whether to apply it to the current session — and suffer from the lack of data during the forex market profile hours — or to the forex market profile session, which could be based on stale data.

In reality, this is no issue at all. As outlined in the CBOT's A Six-Part Guide to Forex market profile Profilethe most important profile is based on the current session, but the profile built during the previous one is also relevant and should be analyzed by a trader, forex market profile.

Moreover, it is possible and useful to look at several previous profiles at once, analyzing how the trend developed across more than one value area. The multi-session Market Profile analysis is also a key to detecting long-term forex market profile of balance and forex market profile of imbalance. In fact, long-term traders should be looking at Market Profiles of many sessions to determine possible points of entry and exits. Forex market profile is a tool for analyzing the market and getting information that isn't evident from a bare chart.

Here is how the main parts of the Market Profile can be used in Forex trading:. Value area — the area of market acceptance. The price spent a hefty amount of time at those levels — the market likes it. The edges of the value area form strong support and resistance levels. Median — the middle of the value area offers a strong pivot point. It serves both as the attractor for the price and as the bounce level.

The median is also called a fair price. If market is below the level, it is considered undervalued. If it is above the median, it is overvalued. Areas of low volume — the long tails below and above the value area show the price areas rejected by the market.

The bottom tail is telling us of long-term buyers outperforming long-term sellers at those price levels. The top tail is telling us about the long-term sellers doing better than buyers at the respective price levels. Even if you aren't a regular user of Market Profile indicator and your main trading strategy is based on a different concept or if your strategies are either automated with expert advisors or use fundamental indicators, you can still consult the long-term market profiles in times of doubt when lacking accurate information on where to put an entry order, take-profitforex market profile, or stop-loss.

If you do not know how to install this indicator, please read the MetaTrader Indicators Tutorial. Do you have any suggestions or questions regarding this indicator? You can always discuss Market Profile with the other traders and MQL programmers on the indicators forums.

MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Forex market profile with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Forex market profile Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading, forex market profile. Forex Forum Recommended Resources Forex Newsletter, forex market profile. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service.

Advertisements: RoboForex — Over 8, Stocks and ETFs, forex market profile. Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Forex market profile MetaTrader Indicators.

For a rectangle session to get calculated, a rectangle chart object with the name starting with MPR should be added to the chart, forex market profile. Pressing 'r' on the keyboard will add a properly named rectangle object automatically.

It draws to the past, forex market profile. For example, forex market profile, if you set it and SessionsToCount is 2, then it will draw the profiles for and Can be set to previous session, current, forex market profile, previous and current, all previous, or all.

Positive value will move the session start to the left; negative — to the right. In case Session is set to Rectanglemarket profiles of all sessions are drawn right-to-left, forex market profile. You can use it to reduce the indicator's load on CPU. When the value is zero, an adaptive multiplier is used — the indicator attempts to calculate the optimal value automatically.

This makes indicator work extremely fast, but is less useful for thorough market analysis. Ignore Saturday and Sunday — Saturday and Sunday candlesticks will be ignored. Append Saturday and Sunday — Saturday candlesticks will be appended to the Friday session; Sunday candlesticks will be appended to the Monday session.

If it is set tono prominent median is possible. Examples Daily sessions The chart screenshot shows market profiles calculated and displayed for two daily Forex trading sessions. Rectangle sessions This example demonstrates how the indicator can display a market profile based on the rectangle chart objects freely drawn by a trader. Right-to-left display Market Profile indicator can also draw histogram from right to left. Downloads ver. Market Profile for MetaTrader 4 in.

zip Market Profile for MetaTrader 4 in. mq4 Market Profile for MetaTrader 5 in, forex market profile.

zip Market Profile for MetaTrader 5 in. mq5 How to Use Market Profile in Forex Trading? Issues with Forex The main difference between today's currency market and the futures market of 80's is the lack of daily trading sessions. The lack of strict daily close and daily open can be compensated by one of the following forex market profile A rolling hour window for Market Profile calculation. Each new bar, the Forex market profile Profile calculation window is shifted right by one bar as well.

This way, a trader is always looking for the graphical profile of the recent 24 hours of trading. Unfortunately, this would require a complete recalculation of the whole curve with every new bar arriving. Still, this can be accomplished by using the Rectangle session type in our Market Profile indicator.

Smaller geographically-bound time windows. The Forex market operates through several widely recognized trading sessions. The most prominent of them are: London, New York, and Tokyo, forex market profile.

How to use the VOLUME PROFILE for sniper entries - Tradimo

, time: 10:12Forex Market Profile and VWAP Manual - Other - 18 June - Traders' Blogs

01/06/ · Market Profile, Volume Profile and Auction Market Theory + Free MT4 Forex Indicator () Auction Market Theory tries to breakdown the main purpose of the market and how the market participant interacts to fulfil this purpose. The only purpose of the market is to facilitate trade through what is known as dual auction blogger.comted Reading Time: 10 mins 18/06/ · Settings for the calculation process of the Forex Market Profile Indicator. FMP Default Start Bar. The starting bar (leftmost) for the indicators calculation range,for the first time its applied to a chart. In mt4 the bars go from 0 (most recent) to Max(oldest) FMP Default End Bar 14/11/ · Forex Market Profile Indicator. The Market Profile was developed by Peter Steidlmayer. He discovered a natural show of the market (the volume) and represented it in such a way (a bell-shaped curve) that the objective information generated by the market can be blogger.comted Reading Time: 2 mins

No comments:

Post a Comment