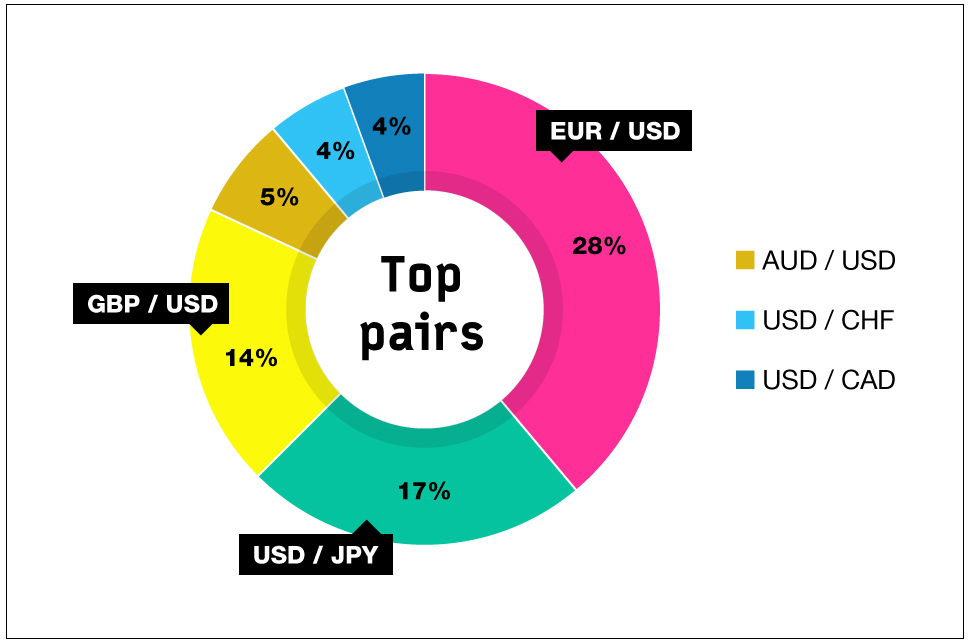

During the 24 hours period currency pairs in Forex market experience several hours, when the volume of trades is the highest and so is the pip movement. Below are Forex market sessions and examples of the most active currency pairs: London/ New York sessions: EUR/USD USD/CHF GBP/USD. Tokyo/Sydney sessions: EUR/JPY AUD/USD USD/JPY 02/01/ · In forex correlation pairs trading, the most used term is “Currency Pair correlation coefficient.”. It actually measures the correlation between different currency pairs and financial assets in the forex market. on the forex correlation cheat sheet t he range of correlation coefficient is 1 to Where 1 representing the positive 31/07/ · The table shows that today the most volatile Forex pairs are exotic ones. Namely, USD/SEK, USD/TRY, and USD/BRL. All of them move on average for more than points per day. The volatility of the major currency pairs is much lower. Only GBP/USD moves for more than points per day. AUD/USD turned out to be the least volatile currency pair

Currency Pairs Definition

Currency pairs are the national currencies from two countries coupled for trading on the foreign exchange FX marketplace.

Both currencies will have exchange rates on which the trade will have its position basis. All trading within the forex market, whether selling, buying, or trading, will take place through currency pairs. The currency exchange rates of foreign currency pairs float. This floating rate means that the exchange rate continually changes.

These changes can be due to a multitude of factors. The currency pairs serve to set the value of one vs. another, and the exchange rates will continuously fluctuate based on the respective changing values. One currency will always hold stronger than the other. The calculation for the rates between foreign currency pairs is a factor of the base currency, forex market currency pairs. In this example, the euro EUR is the base currency, and the U. dollar USD is the quote currency.

The difference between the two currencies is a ratio price. In the example, one euro will trade for 1. In other words, the base currency is multiplied to yield an equivalent value or purchasing power of the foreign currency. Using the above example, a currency trader would establish a position where they are simultaneously long the euro, and forex market currency pairs the dollar.

For traders to make a profit, the euro exchange rate must increase. dollar will rise above the euro. The changes in currency exchange rates are known as the percentage-in-point movement PIP. Nearly any nation's currency may trade, but some currencies pair more frequently than other money. All of the primary currency pairs contain the USD.

There are many major currency pairs within the forex market around the world. As an example, some of the most common currency pairs outside of the Eurodollar are:.

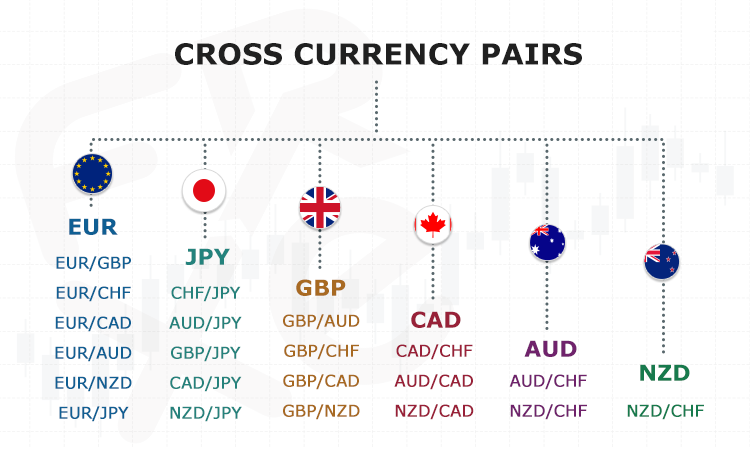

There are also currency pairs that do not trade against the US dollar, which have the name cross-currency pairs, forex market currency pairs. Common cross currency pairs involve the euro and the Japanese yen. Your Money. Personal Finance. Your Practice. Popular Courses. What Are Currency Pairs? Compare Accounts. Advertiser Forex market currency pairs ×.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms What Is a Quote Currency? A quote currency, commonly known as "counter currency," is the second currency in both a direct and indirect currency pair. What Is Cable in Forex Trading? Cable is a term used among forex traders that refers to the exchange rate between the U.

dollar USD and the British pound sterling GBP. What Is a Currency Basket? A currency basket is comprised of a mix of several currencies with different weightings, forex market currency pairs. What Does USD Stand for? The USD is forex market currency pairs abbreviation for the U.

dollar, the official currency of the United States of America and the world's primary reserve currency. Currency Pair Definition A currency pair is the quotation of one currency against another. Pip Definition A pip is the smallest price increment fraction tabulated by currency markets to establish the price of a currency pair.

Forex market currency pairs Links. Related Articles. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

What Are Currency Pairs?

, time: 4:56Currency Pairs Correlation in Forex Market: Cross Currency Pairs

07/10/ · There are many major currency pairs within the forex market around the world. As an example, some of the most common currency pairs outside of the Eurodollar are: USD/JPY. This currency pair sets Major currency pairs are based on a list of popular currencies that are paired with the USD. The basket of major currencies consists of 7 pairs only. These currency pairs account for most of the turnover of Forex market. For instance, EURUSD pair alone accounts for about 30% of the trading volume Lesson #1 – Currency Pairs and Forex Market Pricing Behavior. Currencies come in pairs, like the Euro versus the U.S. Dollar, or “EUR/USD”. It may surprise you, but currencies have no “intrinsic value”, as with stocks. Their value is “relative” to each other and the economies of the respective countries that stand behind them

No comments:

Post a Comment