:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

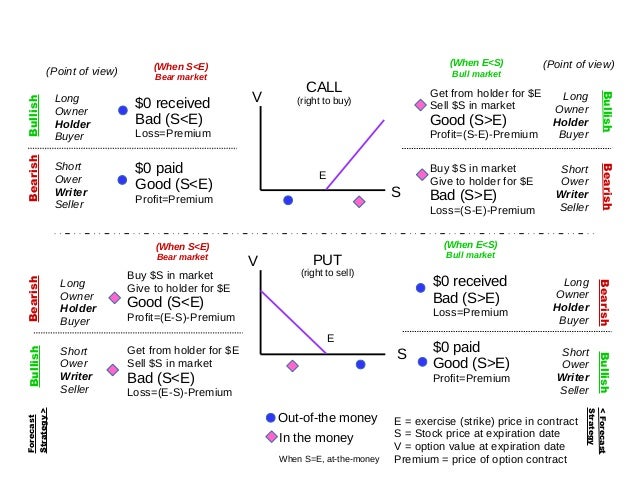

Bull Call Strategy. A Bull Call Spread is a simple option combination used to trade an expected increase in a stock’s price, at minimal risk. It involves buying an option and selling a call option with a higher strike price; an example of a debit spread where there is a net outlay of funds to put on the blogger.comted Reading Time: 8 mins 10/08/ · A call option is a contract between you (buyer) and the seller (writer) of the option contract. Call option contracts are typically for shares of the underlying stock named in Is Accessible For Free: True An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a certain date (expiration date) at a specified price (strike price Strike Price The strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on). There are two types of options: calls and puts

Buy Stock at a Lower Price With Stock Options

It is market wisdom that smart option traders buy cheap options and sell expensive options. And indeed, we frequently see that the ideal option to buy will be extremely expensive and thus riskybuy stock and sell call options, despite the high probability of price movement.

Indeed, the entire concept of covered call writing is built around that core principle: selling overpriced overvalued options to those who ignore this principle. The following graphics illustrate these relationships:. This is simple enough. Call values move in the same direction as the stock, and put values move inversely opposite to the stock price. One who thinks a stock will imminently rise would buy a call to speculate on it; if bearish, a put would be the purchase of choice.

Other than to close a short option position, traders buy stock options for two primary reasons: to hedge an existing stock position, buy stock and sell call options to speculate on the direction of the underlying stock.

Those who expect the stock to go down will buy puts, either speculatively or to hedge a long stock position. Those who expect the stock to go up will buy calls, either speculatively or to hedge a short position in the stock. Because stock options can be bought for a fraction of the cost of the underlying stock, yet give the holder the right to buy calls or sell puts the underlying stock at any time through expiration, they buy stock and sell call options the holder leverage over the underlying shares for the life of the option.

This is leverage. The owners of Southfork cannot sell the property to anyone else until your option expires. Unexercised, buy stock and sell call options, the call will expire worthless. Speculating on stock direction by purchasing options is an old game, and it can work quite well. The problem is that the stock must buy stock and sell call options the desired move before expiration. Thus the option buyer must get both the direction and timing of the stock move right. Traders sell stock options primarily to generate income.

Speculators buy stock options primarily to speculate on an anticipated movement in the underlying stock, since the option will gain in value as the stock moves. Stock Price Movement: Effect on Option Buyers and Sellers Stock Rises Stock Falls Time Passes Call Buyer Positive Negative Negative Call Seller Negative Positive Positive Put Buyer Negative Positive Negative Put Seller Positive Negative Positive The table preceding indicates the various effects on option buyers sellers posed by a rise or fall in the stock and by the passage of time time decay.

Obviously, the stock has to work much harder move further to create profitability for the ATM or OTM call buyer. The more time value the buyer paid, the more the stock must move. Not all long options are speculative. Options are also bought to hedge an opposing position. For example, one who is short the stock might buy a protective call to assure the ability to buy the stock at an acceptable price should the trade go wrong stock goes up. Or one who is long the stock buy stock and sell call options buy a protective put to assure the ability to sell the stock at an acceptable price should the stock fall.

It is critical for anyone writing covered calls or making any kind of option-based trades to understand time value and its importance. For the option writertime value is one of the major sources of return the other is profit from opportunistically trading options as the stock moves.

But for the option holdertime value is a negative because it decays and picks his pocket as time passes. In other words, in order for a long option position to win, the option buyer first must recoup the time value before the trade can become profitable. This is true, because time value decays at a predictable rate as time elapses. In the covered callreturns are generated by the time value portion of the premium, buy stock and sell call options. The following table illustrates how time value works:.

But if the call instead is exercised, the time value is thrown away:. By exercising the call, the holder forfeits the time value. Whenever an ITM call or put has time value, the holder forfeits the time value upon exercise. This illustrates why ITM calls are not exercised before expiration so long as they still have time value. But once time value is gone or nearly gone, it is no longer an impediment to early call exercise and the call writer can face early assignment at any time.

If the call trades below parity below intrinsic valueearly exercise becomes even more likely. Here is a very important point about the economics of buying options: at some point the option holder must either sell or exercise the ITM long option. Otherwise, the buy stock and sell call options will expire worthless. If the holder takes no action by expiration the calls will expire worthless, resulting in the loss of the entire premium paid.

Needless to say, OTM options are never exercised even at expiration, since it would be far more advantageous to simply buy or sell the stock at market.

When Financhill publishes its 1 stock, listen up, buy stock and sell call options. After all, the 1 stock is the cream of the crop, even when markets crash. Financhill just revealed its top stock for investors right now so there's no better time to claim your slice of the pie. The author has no position in any of the stocks mentioned. Financhill has a disclosure policy, buy stock and sell call options. This post may contain affiliate links or links from our sponsors.

Home Investing. The following graphics illustrate these relationships: This is simple enough. Buying Options Other than to close a short option position, traders buy stock options for two primary reasons: to hedge an existing stock position, or to speculate on the direction of the underlying stock.

Previous Previous post: What Is Open Interest? Next Next post: Stock Ratings. Figure 3.

How to SELL a CALL Option - [Option Trading Basics]

, time: 15:27Options Spreads: Put & Call Combination Strategies

An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a certain date (expiration date) at a specified price (strike price Strike Price The strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on). There are two types of options: calls and puts Bull Call Strategy. A Bull Call Spread is a simple option combination used to trade an expected increase in a stock’s price, at minimal risk. It involves buying an option and selling a call option with a higher strike price; an example of a debit spread where there is a net outlay of funds to put on the blogger.comted Reading Time: 8 mins 10/08/ · A call option is a contract between you (buyer) and the seller (writer) of the option contract. Call option contracts are typically for shares of the underlying stock named in Is Accessible For Free: True

No comments:

Post a Comment